It's difficult to keep your finger on the pulse of the ever-changing SBA relief options being offered to small businesses, all the while remaining focused on the operation of your company, staying afloat financially, and ensuring safe practices for the health and safety of your employees. Rest assured Big Picture is here to support you with up-to-date information on various Relief offerings, need-to-know IRS updates and Cash Flow Management. Here's a great article by The Washington Post with some insight into the frustrations and constant changes of the relief efforts being offered.

"Alone, we can do so little; together we can do so much" - Helen Keller

This is a time for us to unite as a community and support each other in every way we can. We CAN get through this and we WILL!

Keep A Tight Grip on Your Cash Flow!

In a time of so many uncertainties your business' cash flow doesn't have to be one of them. Follow these simple steps to protect your cash flow:

CANCEL unnecessary/discretionary subscriptions

CANCEL Auto-Pay - take payments off auto-pay and lower monthly payments where possible

RENEGOTIATE credit cards for lower interest rates or balance transfers where possible. Confirm hold on loans and other debt relief on interest due to CARES ACT.

BUDGET your ongoing Monthly Expenses to what is critical. Eliminate the unnecessary.

PRIORITIZE and EVALUATE Cost/Benefit for Payroll Costs and Contractors spend in light of critical functions, reduce hours where possible, involving staff on reaching these decisions is necessary for long-term retention.

DEFER payment options on Federal, State and Local Taxes

COMMUNICATE with other Service/Utility providers and Vendors to push out/resturcture payments. keep details of all communications and changes to payment activity, and update contracts in writing by both parties.

The goal is to defer payment where possible until operational again and to not incur new operational expenses

SBA Coronavirus Relief

SBA CORONAVIRUS RELIEF – Paycheck Protection Program (PPP)

Fact Sheet: Click Here for more information

The SBA is currently unable to accept new applications for the Paycheck Protection Program based on available appropriations funding. For A Practical Guide of the PPP we encourage to attend this free webinar.

SBA CORONAVIRUS RELIEF – Economic Injury Disaster Loan (EIDL)

SBA is unable to accept new applications at this time for the Economic Injury Disaster Loan (EIDL)-COVID-19 related assistance program (including EIDL Advances) based on available appropriations funding. Applicants who have already submitted their applications will continue to be processed on a first-come, first- served basis. We encourage you, if you haven't already, apply to this program once they re-open applications as Congress continues to push for additional funding.

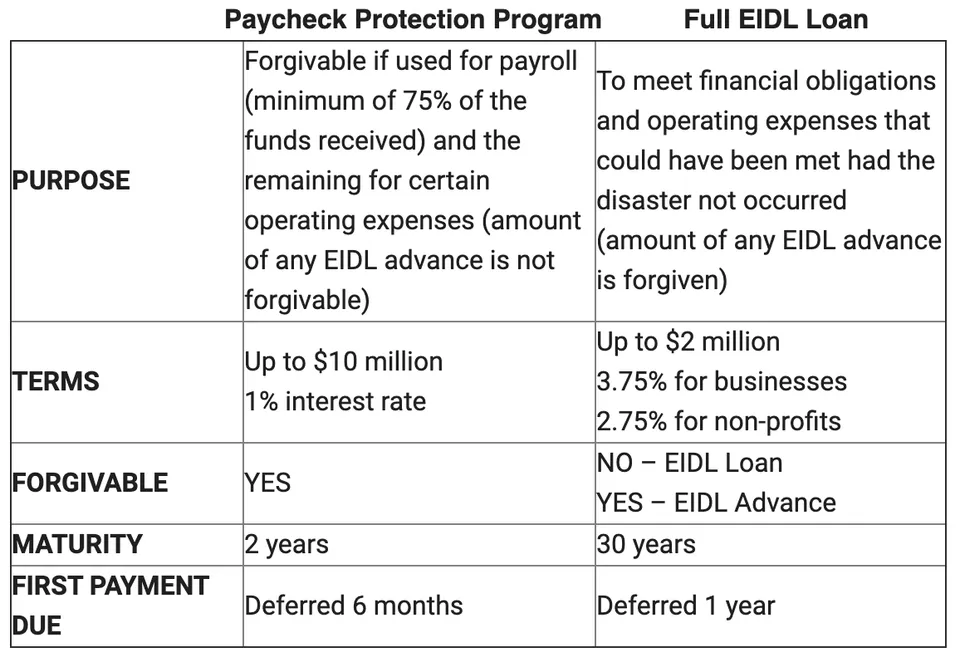

Here's a side-by-side comparison of the two programs:

SBA DEBT RELIEF AND 7a LOANS

As part of SBA's debt relief efforts,

The SBA will automatically pay the principal, interest, and fees of current 7(a), 504, and microloans for a period of six months.

The SBA will also automatically pay the principal, interest, and fees of new 7(a), 504, and microloans issued prior to September 27, 2020

For current SBA Serviced Disaster (Home and Business) Loans: If your disaster loan was in “regular servicing” status on March 1, 2020, the SBA is providing automatic deferments through December 31, 2020. Go here for more information.

You can STILL apply for a 7a loan (not forgivable) through your business bank, for more information on those loan programs click here.

Additional Debt Relief Options

SMALL BIZ RELIEF FUND

The SBRF is continuing to receive donations to fund additional applications, find out more information here. You can also request to be added to their email list so that you are notified as updates are made available.

SICK PAY RELIEF / FFCRA

Sick leave/family leave refundable payroll tax credit. If you have fewer than 500 employees, you must provide 80 hours (2 weeks) of paid sick leave for employees quarantined or experiencing symptoms associated with the coronavirus and seeking medical diagnosis and, for absences due to caring for a child whose school is closed, up to 10 weeks of leave at 40 hours per week.

Provides small and midsize employers refundable tax credits that reimburse them, dollar-for-dollar, for the cost of providing paid sick and family leave wages to their employees for leave related to COVID-19.

Period beginning April 1, 2020, and ending December 31, 2020

Doesn’t fully alleviate immediate Cash Flow concerns as Sick Pay would be paid PRIOR to refundable tax credits (against Payroll Tax deposits), info captured on Form 941 Employer’s Quarterly Federal Tax Return

If the amount of the credit exceeds the employer portion of these federal employment taxes, then the excess is treated as an overpayment and refunded to the employer under sections 6402(a) or 6413(a) of the Code.

Select appropriate codes as communicated by Payroll providers to ensure tracking of Sick or Family Leave paid that will drive credits against Payroll tax deposits

Document any Sick Pay or Family Leave Pay paid along with appropriate documentation from impacted staff.

Find out more details on the Sick Pay Relief/FFRCA here.

New Labor

Law Posters

The COVID-19 pandemic has challenged businesses and government in an unprecedented fashion. In response, the federal government has passed several pieces of legislation including the Families First Coronavirus Response Act signed into law on March 18, 2020. Among the many provisions in the law, effective April 1, employers covered under the Emergency Paid Sick Leave Act and Emergency Family and Medical Leave Expansion Act (FFCRA) are required to post a new notice, the Families First Coronavirus Response Act Notice. Covered employers include private US employers with fewer than 500 employees. The new poster articulates employee rights including paid leave entitlements, qualifying reasons and enforcement under the new leaves.

IRS Related Updates & Resources:

IRS Stimulus - expected to be received this week for those that have filed 2018 or 2019 and for which the IRS has your Direct Deposit info. Otherwise, paper checks will be mailed out over the course of several weeks into July 2020.

IRS Net Operating Loss change in tax law - harvest refunds on prior years taxes owed/ paid

IRS Employee Retention Tax Credit (ERTC) - Taken against payroll taxes if your firms operations were suspended by a government over of if the firm experienced an income drop of 50%. Important: A business can take either ERTC or the PPP - if it takes the ERTC, it cannot take the work opportunity tax credit, Families First paid leave credit or paid leave credit.

IRS Tax Filing Extensions - Internal Revenue Service (IRS) is automatically postponing the April 15 federal income tax return and payment deadline (including payments of tax on self-employment income) for 90 days - without any interest, penalties, or additional to tax for failure-to-file to July 15. Extension deadline remains October 15th, 2020.