Classifying an employee as an Independent Contractor without a reasonable basis can result in having to pay employment taxes for that worker IF you are audited.

You will need to collect a W9 from an Independent Contractor if you hire them for services over $600. We recommend collecting these at the start of engaging their services

Contractors paid over $600 will need to be issued a Form 1099-NEC (for Non Employment Income, previously Form 1099-Misc through 2019) or Form 1099-Misc (for Rents and other Income Payments) by February 1, 2021. For more information on that take a look at 1099 Prep Steps for Success and Rules Regarding Form 1099.

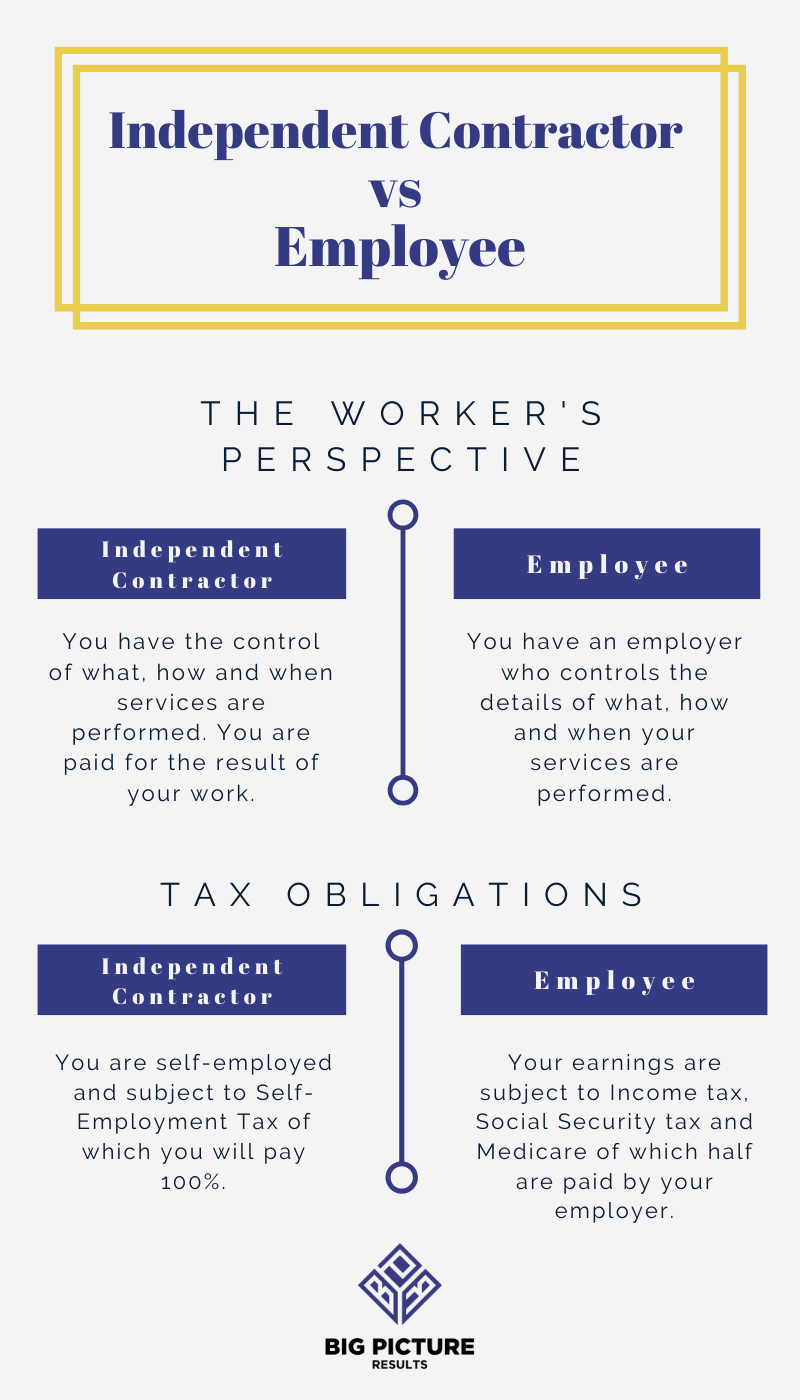

Further clarification on who can be considered an Independent Contractor and who's an Employee can be found here.