Happy New Year All!

We are barely two weeks in, and I don’t know about you, but I am already over the clichés sitting in my inbox. From “New Year, New You” to “How to Survive 2022”, I know we can all do better and grab 2022 by the cojones!

The last two years since the start of the pandemic have been ripe with unique business challenges: from ever-changing guidance on COVID-19 tax law and emergency funding, to the “great resignation” related labor shortage, to parting with clients, vendors, and team members that either did not weather the storm or pivoted as needed.

Driven by our obsession with mindset, creative thinking, resilience, action, and accountability, I am elated to report that 2020 and 2021 have been our best years yet. Easy? Definitely not. Worth it? Absolutely. Because we are here to help you, always - so that you, business owner, inventor of your own life, are doing and making MORE in LESS time.

I invite you to get inspired this year and commit to growing beyond survival mode - instead thriving past what you thought possible. Shortcuts such as the video below (need a good laugh?) are many, but the truth is there is no replacement for sound strategic planning and execution. This is our wheelhouse, so DO hit us up for a chat on your 2022 game-plan - we’ve got you! In the meantime, check out the helpful resources below.

- Jessica Hornbeck, CEO & The BPR Team

Services

BPR can help you with Tax Prep, Sales Tax filing, Full-Service HR support

Best Practices

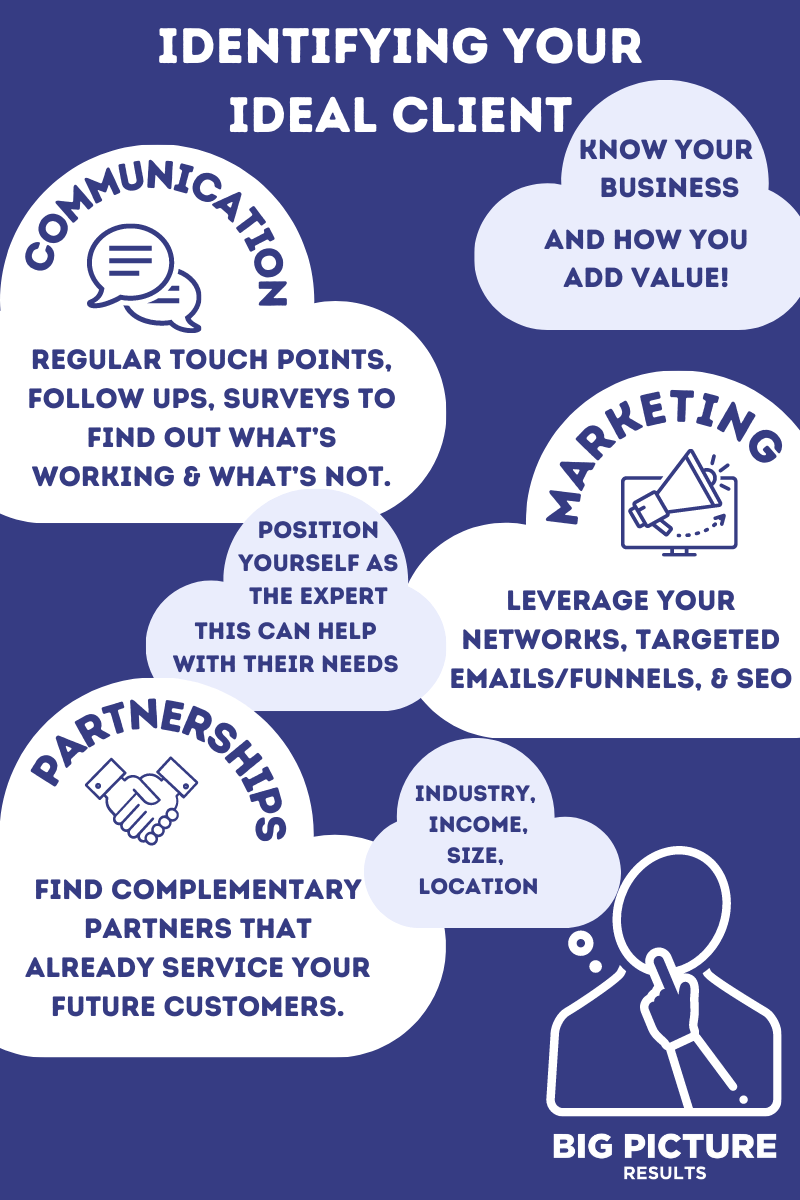

Find your IDEAL Customers and Keep Existing Customers Happy

Have to Part ways with a Customer that is not a good fit? Check out THIS Woodward Report read to ensure you are not compromising your Team and Organization’s long-term ability to grow for a few bucks today...

Cash Flow & Money Moves

State Small Business Credit Initiative (SSBCI)

This program will be funded by the Department of Treasury with $895M going to California. Info on the initiative HERE.

Action Opportunity Fund California Rebuilding Fund is one of the lenders

Deadline was 12/31/21 but appears to remain open

If you were pre-qualified by 12/31/21, complete your application OR if you have NOT yet applied, determine if you qualify HERE Or see a list of Lenders HERE.

Grants

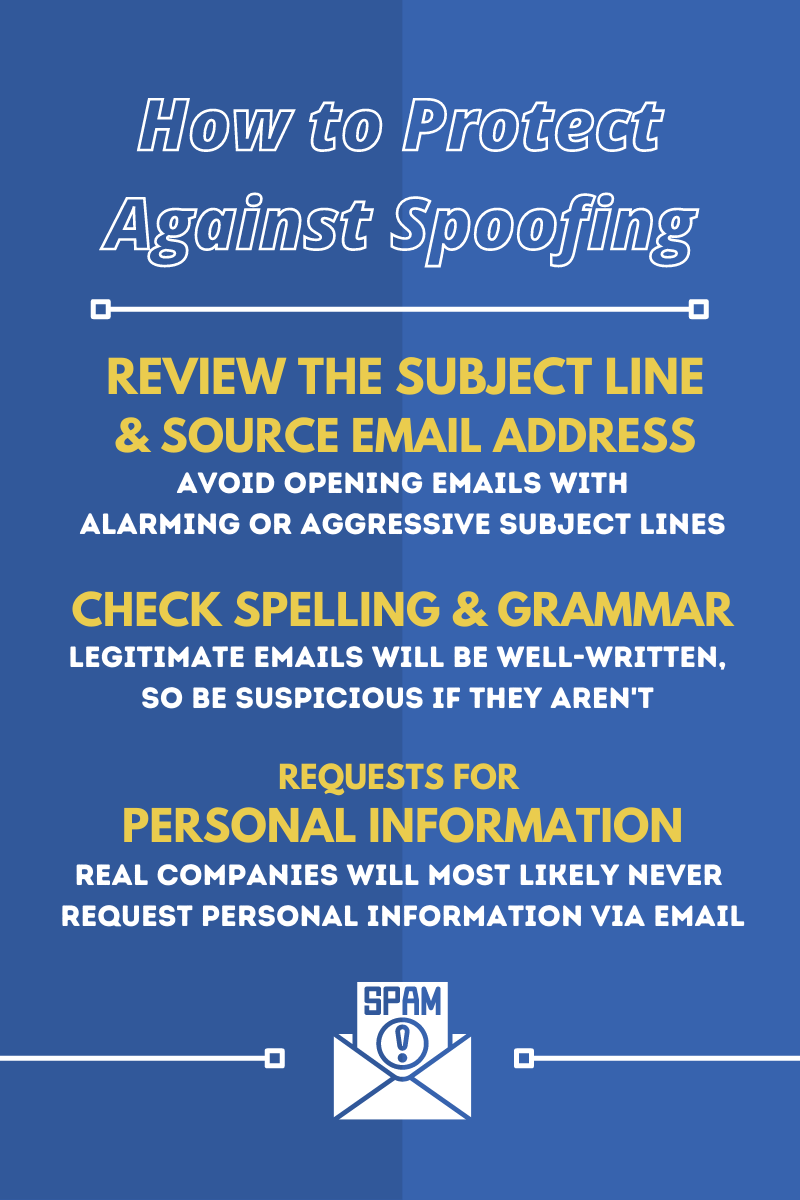

Here are a few tips for recipients of Loans and Grants to protect against Spoofing.

Hello Alice - Our favorite resource for specific grant opportunities, check back often or sign up for their newsletter. SCORE’s webinar on How to Access Capital for Women

Federal funding opportunities at Grants.gov for organizations and entities supporting the development and management of government-funded programs.

Workforce Partnership programs - Check out these subsidized work programs in San Diego that allow employers to staff their Teams without bearing the entire cost burden, as well as similar programs offered in other cities.

COVID-19 Resources & Funding Updates

SBA EIDL Loan Increase – As of January 1, 2022, the SBA is not able to accept applications for new COVID EIDL loans or advances. The U.S. Small Business Administration (SBA) will accept and review reconsideration and appeal requests for COVID EIDL applications received on or before December 31 if the reconsideration/appeal is received within the timeframes in the regulation. This means six months from the date of decline for reconsiderations and 30 days from the date of reconsideration decline for appeals – unless funding is no longer available. Borrowers can request increases up to their maximum eligible loan amount for up to two years after their loan origination date, or until the funds are exhausted, whichever is soonest.

Employee Retention Tax Credit (ERTC) – Dependent on the decline in gross receipts (must be >20% in 2021 vs a comparable Quarter in 2019), # of Employees, and other criteria, businesses may be able to apply for retroactive credits. Please work with your payroll provider on completing the application and AMENDED 941X Payroll Return.