The Back to School season kicks off a whirlwind of activities, gatherings and To Dos leading up to the holidays and New Year. For many, we are too busy doing (and spending!) that our year-end financial situation looks like it's either an after-thought, or at best rushed during the last week of the year.

One of our commitments as a strategic guide and resource to our community is to put you in the driver's seat - today and long term. Check out the helpful resources below (in addition to our website and social media channels) to support you as we near year-end and do let us know if you'd benefit from talking through any and all of the above, always!

Best Practices

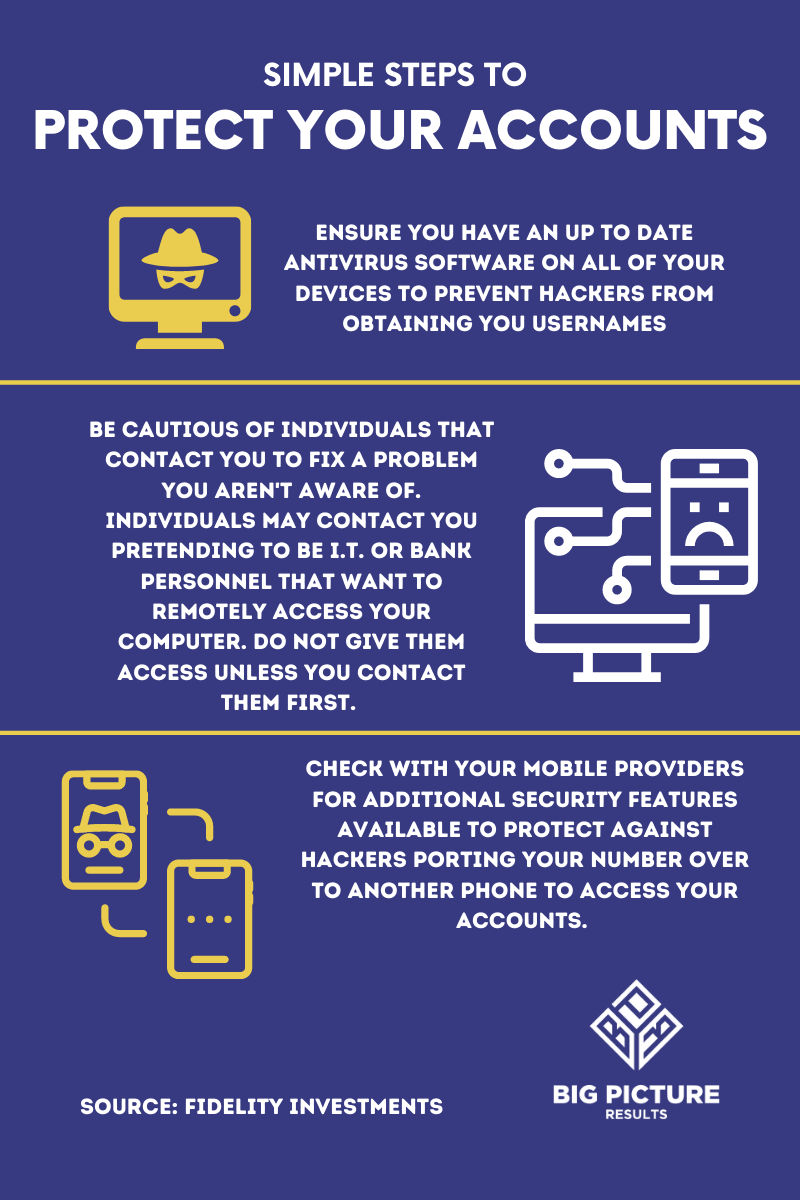

October is Cyber Security month. In addition to the Best Practices for password protection included in last month's newsletter, here are a few more tips to safeguard your accounts.

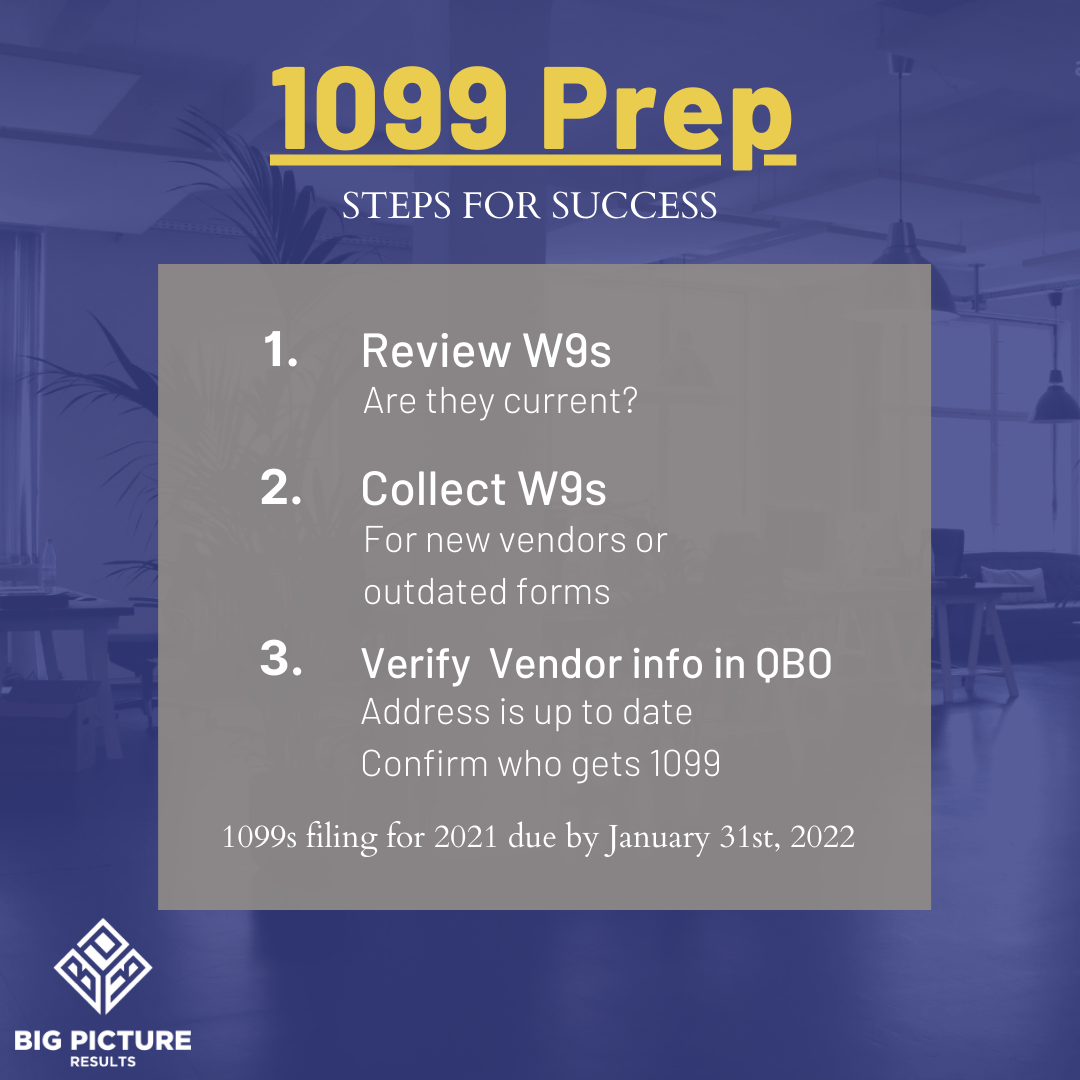

NOW is the time to ensure you have all of your ducks in a row for IRS form 1099 due January 31st, 2022. For our Client Community - we will be reaching out to obtain and verify missing W9's and payments in the coming weeks. Visit the IRS website for more information.

Big Picture Results sends to your vendors electronically.

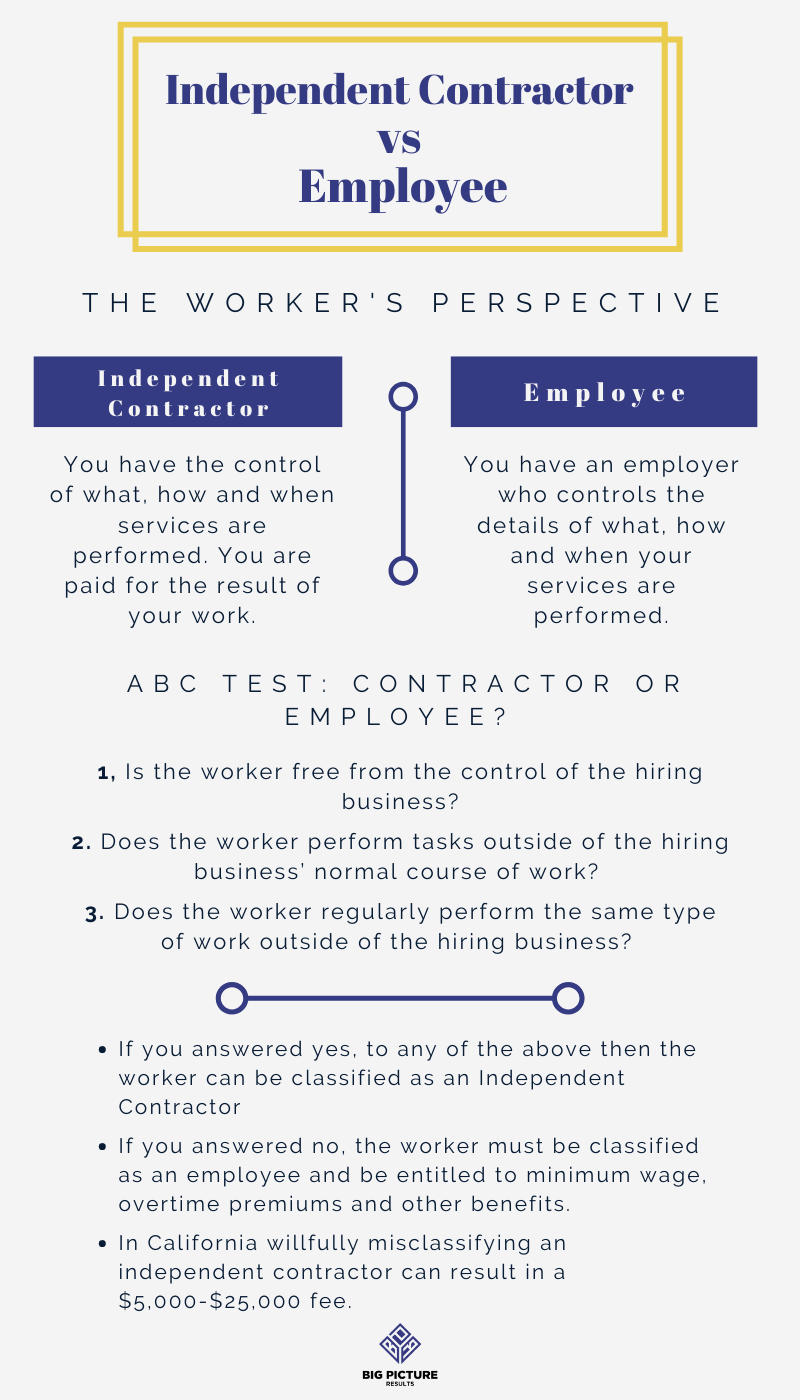

A common and costly mistake made by business owners is misclassifying a 1099 Contractor that should have been hired as an employee. The penalty for misclassifying a worker can be detrimental to a small business. It's important to consider the following:

Cash Flow, Capital and Year-End $ Moves

There are MANY ways to maintain positive cash flow, preserve capital and proactively reduce your taxable Income by investing in your business PRIOR to year-end.

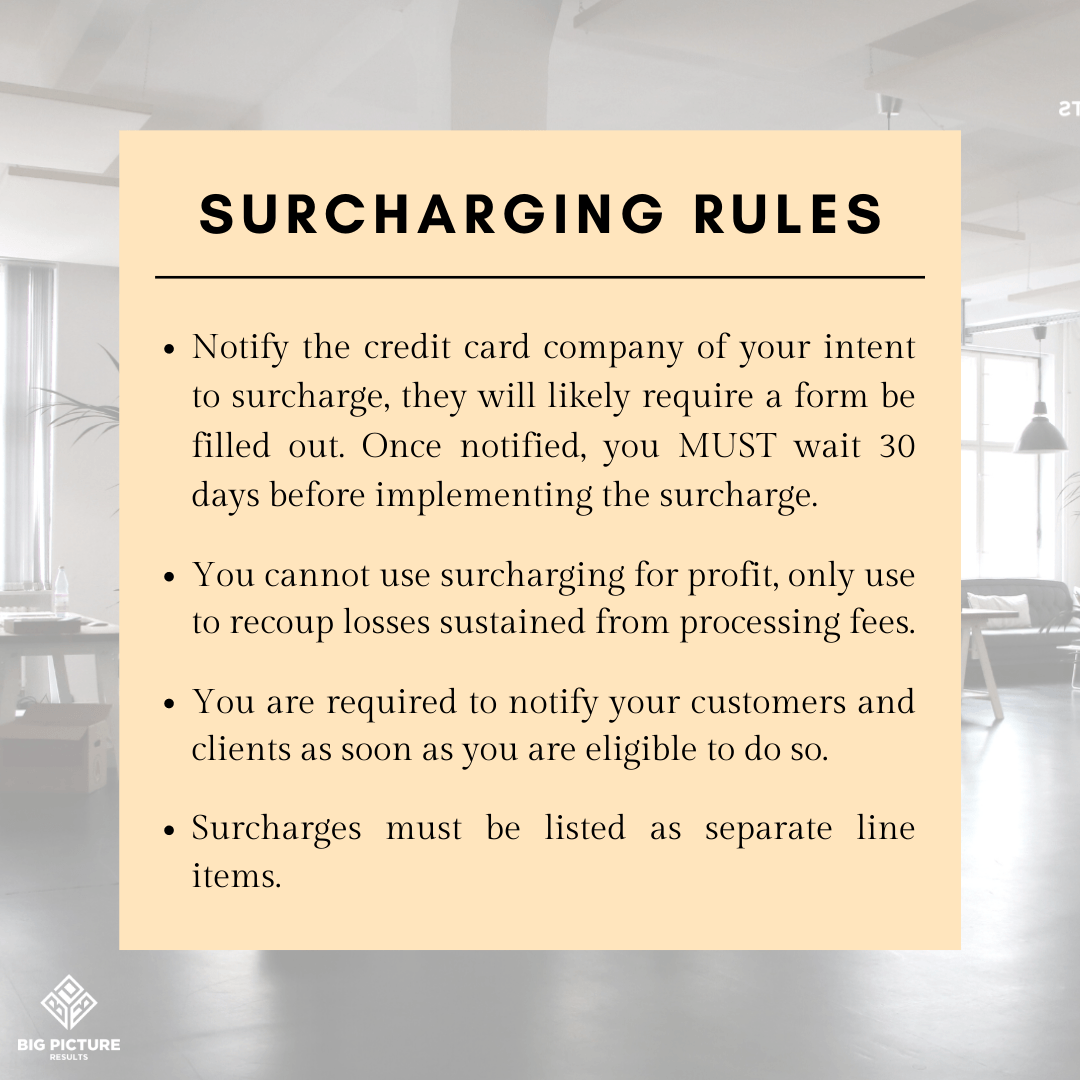

CASH FLOW - So long as you appropriately notify credit card companies that you are adding a 'surcharge' to customer invoices & receipts, you are allowed to recoup credit card fees in California and other states. These costs might be smaller individually but add up to big dollars over the course of a year, dollars that can be re-invested in your business.

YEAR-END $ MOVES - If you find yourself with excess profit, congrats! That's a good problem to have. However - If you want to lower your taxable income and taxes, we recommend:

Advance payments on expenses so long as the benefit received is not greater than a year out, you may be able to fully expense this year's costs associated with annual subscriptions and payments. Do speak with a savvy CPA to ensure you are in compliance with the IRS.

Rewarding your Team - pay out bonuses before the year is up, arrange for a Team Building event, or throw a party for your staff and Clients.

Consider covering Continuing Education expenses for your Team INSTEAD of having them use their compensation to cover it themselves - save on Employee and Employer Taxes!

Auto - IF you use a vehicle for business, consider purchasing prior to year-end. A small vehicle (weighs less than 6,000 lbs) used for business purposes has a deduction limit of $10,000 while a heavy vehicle (weighs over 6,000 lbs) used for business purposes has a deduction limit of $25,000. Discuss Section 179 deductions with your CPA.

Re-invest profits by purchasing technologies that will help you automate and improve key processes.

Is Rent a big expense for your business? Consider purchasing a building or facility that saves you on rent expenses WHILE building equity in an Asset for your business.

Equipment Purchases to be fully depreciated this year

Contribute to Company Retirement or Health Savings Accounts

Insurances - pay deposits/premiums in lump sum for following year

Charitable Deductions

Writing off Bad Debt

Updates on COVID-19 Programs

Claim the ERC for 4th quarter of 2021 - The IRS extends the Employer Retention Credit once again along with some modifications. Eligible employers can receive up to $14,000 in additional credits per employee, or up to $33,000 in refundable tax credits per employee. This is a refundable tax credit to offset your payroll taxes and get money back.

SBA EIDL Loan - for those that have received EIDL loans, you may be able to request an increase directly via the SBA.

Helpful Funding Resources

Did you know that California issues tax credits for hiring Employees? California Competes Tax Credit (CCTC) is an incentive to businesses that want to relocate to California or stay and grow in California, an income tax credit is available by application. Read more about how this program has worked for other businesses here. Our CPA partner Class Advisors can help you file for these credits!

Workforce Partnership programs - Check out these subsidized work programs in San Diego that allow employers to staff their Teams without bearing the entire cost burden, as well as similar programs offered in other cities.

California Small Business Grant - This grant program continues to progress into Rounds 8 and 9. Check to see if you're eligible to apply in the latest rounds.

Female Founders of Color - 30 female founders of color will be awarded $25,000 grants, virtual coaching and skill-building opportunities provided by Project Entrepreneur. Applications are now being accepted until November 10, 2021 at 6pm ET.